Hi, I’m Sam Price director and Brisbane Buyer’s Agent from Templeton Property and today I’d like to answer a question we are asked quite frequently – What to consider before buying a unit or townhouse in Brisbane?

When it comes to buying a unit or townhouse, and also an apartment in Brisbane, it’s important to remember that the purchase process, due diligence and even the ongoing costs and responsibilities are very different to that of buying a standard detached house. Living in a unit or townhouse complex has become a popular choice for many in recent years and there are indeed many advantages over a house such as convenience, affordability, security and maintenance. This blog seeks to provide an overview of the key factors to consider when buying a unit or townhouse in Brisbane.

Will it suit my needs?

Whether you’re attracted to a unit or townhouse for its convenience, affordability, lifestyle or as an investment, it’s important to check that it will meet your requirements both now and into the future.

Questions to consider my include: Can I continue living in the property if my family expands? Can I have pets living with me? Do I mind living close to my neighbours? Will I miss having a yard? As an investment, will it continue to be attractive to tenants and have capital growth in the future? Should I be buying a unit or a townhouse?

What is the difference between freehold and body corporate?

Investing in a freehold property such as a detached house, enables the property owner to have complete control over the land and the improvements. This allows the owner to make the decision to renovate and make improvements to the property. The owner is also liable for all expenses, maintenance, rates, and insurance applicable to their property.

On the other hand, when you buy a unit or townhouse with a body corporate, the owner is only responsible for the internal area of their individual structure and courtyard if a townhouse. The body corporate is established for the purposes of regulating and maintaining the external structures, common area as well as the rules and regulations called by-laws. The individual owners contribute funds (admin and sinking fund levies) to the body corporate to manage the maintenance, body corporate, insurance etc. Accordingly, any significant or external modifications to the structure requires body corporate approval.

Buying a unit or townhouse new versus established

New developments often have modern fit out and décor, swimming pools and gyms, and it’s easy to see why many people are attracted to these complexes. As a Brisbane Buyer’s Agent though, we avoid purchasing new units and townhouses, unless having been specifically directed by our client. We prefer buying into an established complex where the body corporate is mature, the re-sale market and demand is known, the building has had time to ‘settle’ and the premium for ‘new’ is no longer a factor.

Established properties can be more spacious, character filled and lend themselves to being renovated and therefore the ability to add value, and the resale market is known and body corporate and sinking fund well established.

In recent years, there has been a number of high-profile cases with regards to high rise buildings with major quality and structural defects. This highlights the importance of quality due diligence prior to purchase and should caution buyers about the risks associated with purchasing off the plan and newly built developments. Further to my note above regarding avoiding new units and townhouses, we also do not purchase property ‘off the plan’ (where the property is yet to be built).

Future supply

Before you buy a unit or townhouse, always consider the number of similar properties that are both already built in the area, and also the possibility and probability that more will be built. Capital growth is about supply and demand, and you are best off looking for a property where supply is restricted, which in turn will increase the demand and value of your property into the future.

What is a Body Corporate?

If you’re purchasing a unit or townhouse in Queensland, you are most likely purchasing into a community titles scheme on a property with a body corporate. The body corporate is the entity that was created in law when the land was originally portioned and was legally registered to create the community titles scheme. The body corporate is the entity responsible for the administration of the common property and other assets owned by the body corporate. They do this for the benefit of all the owners within the unit or townhouse development and their role is set out in the relevant legislation.

What are the duties of the Body Corporate?

These include:

- Making and enforcing rules which are called by-laws

- Looking after the maintenance and management of the common property areas

- Looking after the insurance for the buildings, other assets and public risk

- Calculating and collecting body corporate fees to ensure the upkeep of the body corporate

- Record keeping including minutes of meetings, current ownership details, accounts asset register

Each year, the body corporate is required to have an annual general meeting to decide on the annual levies that lot owners must pay each year.

The Queensland Government also provides information in relation to the duties of a Body Corporate etc. Clink here for the direct link.

Who are the members of the Body Corporate?

When you purchase a property that has a body corporate, you automatically become a member, though it is up to you whether you are an active participant or not.

In Queensland, its required that the body corporate elect a committee to:

- Oversee the day to day running of the body corporate

- Make decisions on behalf of the body corporate

- Actioning lawful decisions of the body corporate

- Administrative duties

The committee must have more than 3 members but not more than 7. If there are less than 7 lots, then the members of the committee can’t exceed the number of lots.

What levies or bills will I receive when I own a unit or townhouse in Brisbane?

When you become an owner of a property that has a body corporate, you will be required to make ongoing financial contributions to the running of the body corporate and the current and future upkeep of the complex.

The amount you will be required to pay fluctuates widely based on may factors such as the size and age of the complex and the amount of maintenance required to maintain the common property assets and amenities. For example. a complex with pools, ornate gardens and lifts will be much more expensive than a simple complex without these high maintenance improvements.

Levies are often invoiced quarterly and if not paid on time, can incur exorbitantly high interest rates for late payment of 20% – 30%.

There may also be instances where you are required to pay a special levy. These are levies which cover extraordinary or unexpected expenditures. These levies are becoming more common as the original unit complexes and town house estates reach an age where costly work is required. If the body corporate meeting approves a special levy, a bill is sent to each unit owner for their share of the levy.

Body Corporate and Community Management Act 1997 (the BCCM Act)

What other bills will I receive when I buy a unit or townhouse?

Additional to the body corporate levies due as contributions to the administrative and sinking funds, you will also be individually responsible for:

- Brisbane City Council rates invoice

- Urban Utilities water and sewerage invoice

- Contents insurance

- Utility invoices such as electricity and gas

- Land tax if applicable

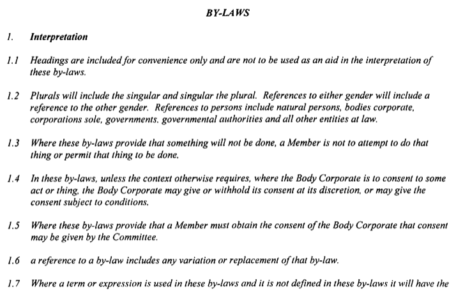

By-laws

The by-laws that relate to the complex can either be the generic by law provided for body corporates in Queensland (often the case for smaller, older complexes), or complex related laws drafted especially for that scheme. If you are buying a property with a body corporate, it is very important that you have reviewed the by-laws, as they govern the owners, occupiers (including tenants) and any guests while either within each property and whilst on the common property.

Disclosure Statement

It is the law in Queensland that anyone selling a property with a body corporate and or community management scheme must provide you with a disclosure document prior to signing a contract to purchase. Should this not be provided to you, you are well within your rights to cancel the contract. You may also cancel the contract should the information provided be false.

The disclosure statement should, amongst other things, include:

- The number of annual contributions that you will be required to pay

- The dollar amount of the annual contributions currently fixed by the body corporate as payable by the owner of the allotment

- The details of any improvements on the common property which the owner is responsible

- Any other information prescribed under the regulation module applying to the scheme

In most instances, the disclosure document does not provide sufficient information to make an informed decision on the well-being and financial health of the body corporate. It often does not even provide the current sinking fund balance.

What additional searches should I do before buying a unit or townhouse in Brisbane?

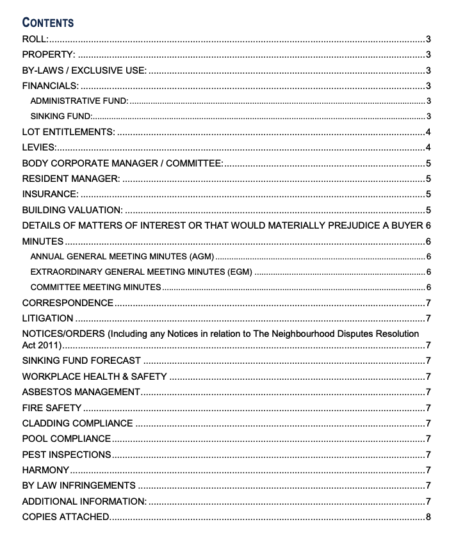

It is important to undertake thorough due diligence when purchasing a property with a body corporate. To do this properly, it will require a search of the body corporate records. This is often undertaken by your conveyancing solicitor and includes an actual physical review of all the records held by the relevant body corporate company. This can often mean reading through hundreds of pages of minutes of previous body corporate meetings, quotes and reports provided in the search package. When we as Brisbane Buyer’s Agents are reading through these documents, we are looking for any red flags that can alert us to significant and costly expenses in the future (special levies). It can also alert us to a committee that is not functioning well.

Areas to pay attention to:

- Inspection reports e.g., retaining walls, water leaks, fencing, structural cracking

- Insurance reports; certificate of currency; insurance claims

- Financial reports

- Sinking fund balance and forecasts – this balance should be a material sum

- Review minutes of meeting for several years and any extraordinary general meetings

- Mention of special levies

- Maintenance plan and budget for the he next 5-10 years

- Complaints and requests of owners and neighbours

- By-laws

- Legal claims

- Compliance certificates for pools, fire, classification

Please note:

- The cost of a full body corporate search can be $300 -$500

- The search can take 7-14 days to obtain

- In a perfect world, this would be obtained for every purchase of a unit or townhouse in Queensland

- We recommend including a special condition in the contract allowing for this search and the buyers absolute discretion (refer to your solicitor for wording)

- Over the years we have reviewed many body corporate records, which discussed future expensive repairs and maintenance works and special levies, that were not disclosed by the vendor

- The search is well worth the money and highly recommended

- Also, please don’t forget about the standard due diligence that should be undertaken for any property purchase such as: Assessment of value based on sales; flood search; school catchment search; encumbrances, pest and building inspection; legals etc.

What’s it worth?

Looking at what other properties in the complex and local area have sold for recently, is the best form of direct comparison to establish value. To do this, start by reviewing the sold section on realestate.com.au and ask the agent for a printout of sales in the complex and the suburb for the last 12 – 24 months.

Like all property purchasers, there are risks involved in buying a unit or townhouse with a body corporate. Undertaking a comprehensive due diligence search and investigation is the best way to determine if the property you are considering meets your requirements and is free of known issues. Being well formed with regards to the body corporate prior to going unconditional allows you to make an informed decision with regards to the lot and the complex that you are buying into.

Have a property related question you would like answered?

Feel free to contact us via email admin@templetonproperty.com.au or call 07 3368 1988.

We look forward to hearing from you.

Sam Price, Director & Buyer’s Agent – Templeton Property Brisbane.